Money can be overwhelming.

Do you have all your bases covered?

Four paths to better outcomes through planning

-

Substance

We get to the right financial decision.

Our families have varying complex needs, but we’re comfortable in all areas of personal finance.

We have years of experience with navigating major financial decisions can cascade across many areas of a balance sheet or income statement.

In digging into the substance of your finances we aim to get the necessary fundamental knowledge regarding your situation so we can guide you to the best outcome.

-

Organization

We add order to chaos.

Despite financial success, many families haven’t sufficiently inventoried or organized their accounts and records.

In building out clear financial statements we can streamline reporting which leads to better decisions and execution.

-

Process

The best design is nothing without proper execution and maintenance.

We develop a cadence of communication to ensure efficiency throughout the year.

This varies based on family needs and wants, but you should expect to hear from us several times per year.

-

Security

In becoming your household financial expert we can keep any eye on things to maintain quality, execute ongoing tasks, and anticipate changes.

If something arises we know the situation, have the data, and we’re ready to help.

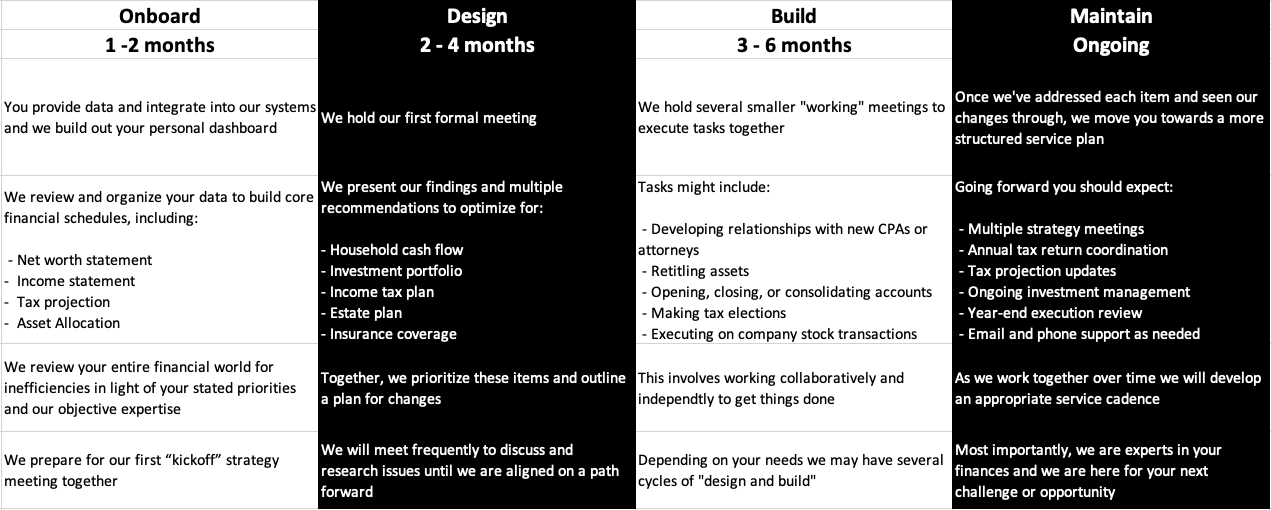

Our First Year Together

BOULDERS

ROCKS

PEBBLES

SAND

WE MOVE THINGS IN THIS ORDER

Our service and deliverables

Our responsibility for your entire financial world.

-

You need clear and organized data to make the right decisions. We build and maintain that for you.

-

We’ll be your partner in making financial decisions large and small. Whether that’s restructuring an entire estate plan or evaluating taxes on your equity compensation—we’re here to guide you.

-

It’s not done until it’s done.

We will serve as your execution partner on everything from rebalancing an investment portfolio to retitling beneficiary designations or making elections during your employment open enrollment period.

-

With accurate data feeds and frequent communication we meticulously maintain what we’ve built and stay read for changes in life, laws, and markets.

Hypothetical Use Cases

FINANCIAL COMPLEXITY OUTSIDE OF INVESTMENT PORTFOLIOS

Equity Comp Questions

Equity compensation is an incredible wealth building opportunity, but also complex and confusing.

We distill your complexity into easily understandable schedules to help you make the right tax elections, and leverage your potential windfall over time.

For many clients we have a quarterly call to review positions and model various tax and investment scenarios—then we help you execute.

Executives

Don’t run afoul of insider trading rules and shareholder guidelines.

For C-suite executives and board members of public companies, we will coordinate with your investor relations group to get the most of your opportunity while staying compliant and tax-efficient.

I Made Partner!

Equity partnerships within consulting, law, and financial firms come with exceptional complexity regarding compensation, benefits, and the cash-flow timing.

We will research your options to help you make the best decisions on benefits, and stay ahead of your quarterly or annual requirements.

Liquidity Planning

It’s not what you make, but what you keep .

Planning well in advance of major transactions will ensure maximum income and estate tax efficiency.

As liquidity materializes we will be ready to implement our agreed upon plan .

FIRE

Many burnt-out high performers are fortunate enough to explore early retirement.

We will help design this plan to explore your options to sustainably live on your savings.

Outgrown DIY

Even the savviest do-it-yourselfers outgrow their own skillset and would benefit from professional advice.

Self-reliance can take you far enough, but if you feel like it’s time for a pro, we can help without having to take over your finances.