Investment Philosophy

-

We are indexers

The jury is out and it’s foolish to try and beat the market. There is a 5% chance of success and nearly 100% chance higher fees and taxes. Tracking the market is achievable, scaleable, inexpensive, and tax efficient. Market returns are sufficient to meet your investment goals.

-

Don't speculate

Humans are terrible at predicting the future. True investing is a strategic endeavor that has a high chance of success over the long term. Speculation is a short term bet that often times requires risking something you have and need for something you don’t need.

-

Control what you can

Overall asset allocation, fees, taxes, and account type are totally within your control and will be the driving performance factors over the long term. You can’t control the effect of macro economics on your portfolio over the short term, but many go crazy trying.

-

Stay on a schedule

Consistent oversight on your portfolio through periodic reviews will improve outcomes. Don’t let things drift or get stale if your circumstances change.

-

Volatility is healthy

Over the short term markets go everywhere, which is normal and healthy. So long as you have sufficient cash and bond reserves you should never have to sell during volatile times. If you try, we will help you think through it.

-

Understand your risk

Anticipate your projected cash needs so you never have to sell your investments to pay for something. We talk through your expected outflows to never make you a forced seller of volatile assets.

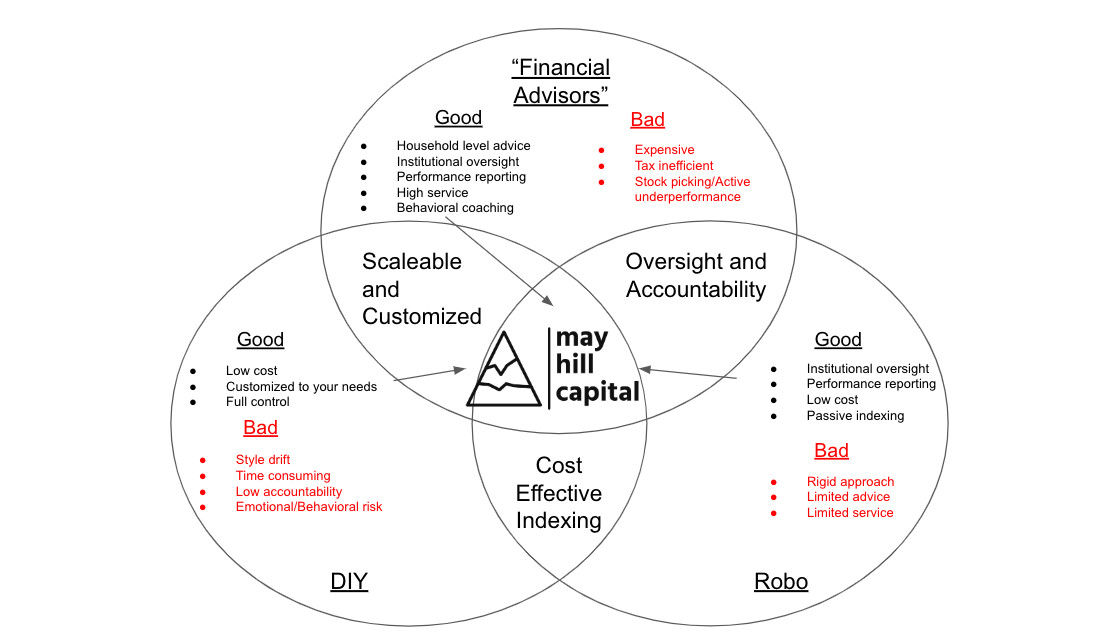

You have basically three choices for investment management.

Do it yourself

Roboadvisor

Traditional financial or investment advisor

All of these have relative costs and benefits. We seek to give you the benefits of these three options while being mindful of costs and unneeded complexity. Coupled with our robust planning service, effective investment management becomes a force multiplier.

The benefits of professional investment management

Better Support

You have a direct line into a team of humans that will take care of all the paperwork, money movement, and relaying information to your team. This includes:

Moving funds between your accounts or out to third parties for things like tax payments, real estate closings, or capital calls.

Retitling your assets, changing a beneficiary, or opening, closing, or consolidating accounts.

Having direct access to your account info to provide to CPAs, Estate Planners, or mortgage brokers.

Better Information

Our planning conversations help us better position your investments. We don’t just view your managed accounts in a vacuum.

Our portfolio decisions are largely informed by what we learn about your overall situation with cash flow projections, balance sheet, and income taxes.

We advise on your investments at the the aggregate household level rather than isolated accounts.

Your investment accounts should talk to each other, and the rest of your financial world.

Better Process

Professional investment management allows for better alignment and accountability. Even the simplest portfolios can drift out of strategy. There is no “set it and forget it.” Our consistent communication with you and daily oversight to the portfolio keep things on track.

Your portfolio has a clear goal and objective performance standard in the form of a custom benchmark.

We have systems in place to stay on track with needed rebalancing, tax-loss harvesting, and overall risk assessment.

Behavioral Coaching

We serve as a buffer between you and the panic button. While this is much “softer” than the other benefits, it helps quite a bit during the scariest times.