wealth planning built around your unique needs

FINANCIAL PLANNING

“Plans are of little importance, but planning is essential ”

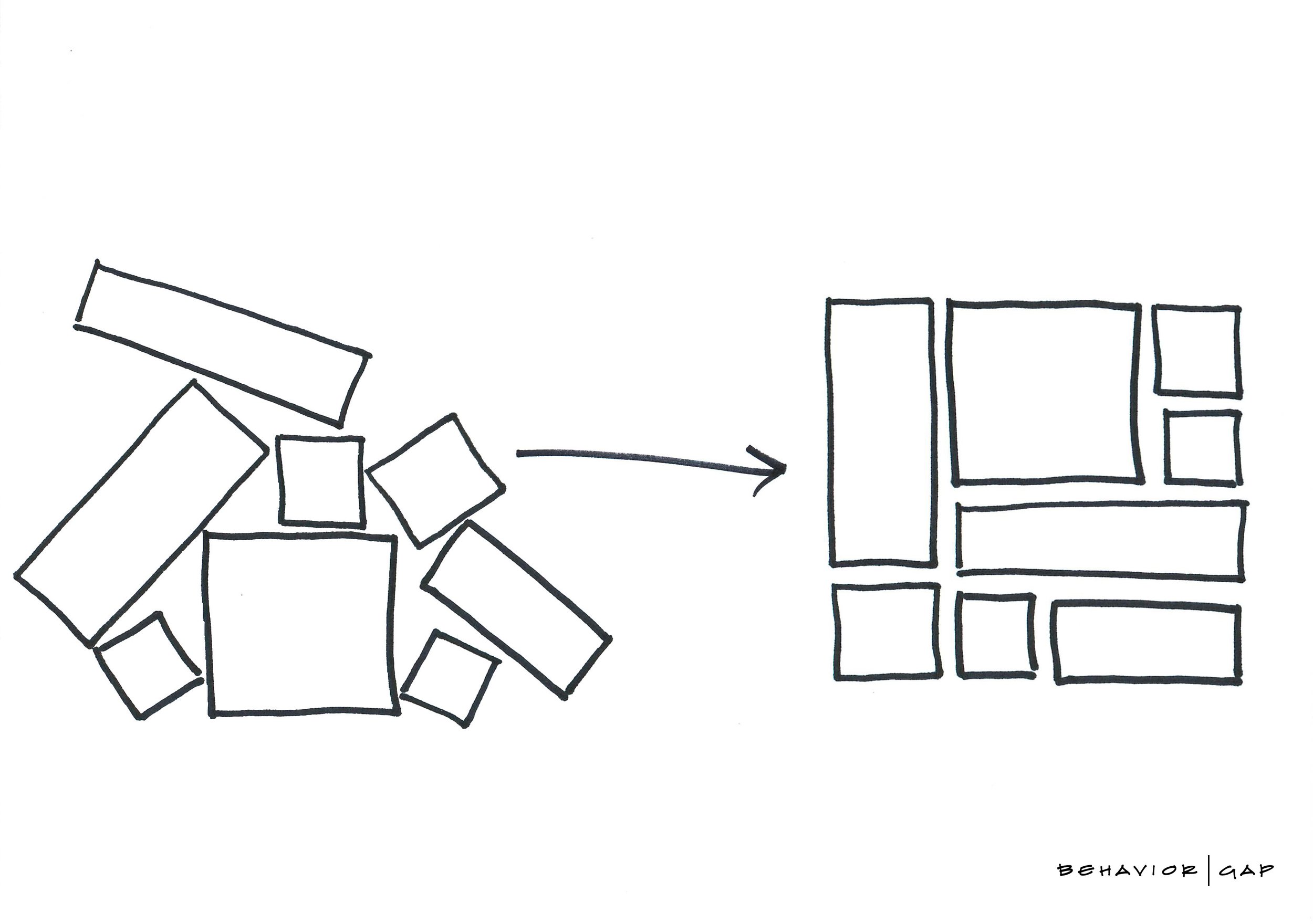

We believe in the value of thinking things through, and that what gets measured, gets managed.

We proactively examine your household cash flow, income tax, investment portfolio, insurance coverage, employment benefits, and estate plan—and we make sure they all talk to each other.

It all starts with a conversation about what you want.

INVESTMENT ADVICE

“The big money is not in buying or selling, but in waiting.”

Investing well doesn’t require a crystal ball.

Avoiding underperformance is more important than outperforming a broad market benchmark.

Compounding market returns are the most efficient long term wealth multiplier.

Solve for fees, taxes, and your own emotions when things are volatile.

Strong emotions generally do not produce positive investment outcomes. We help you stay grounded.

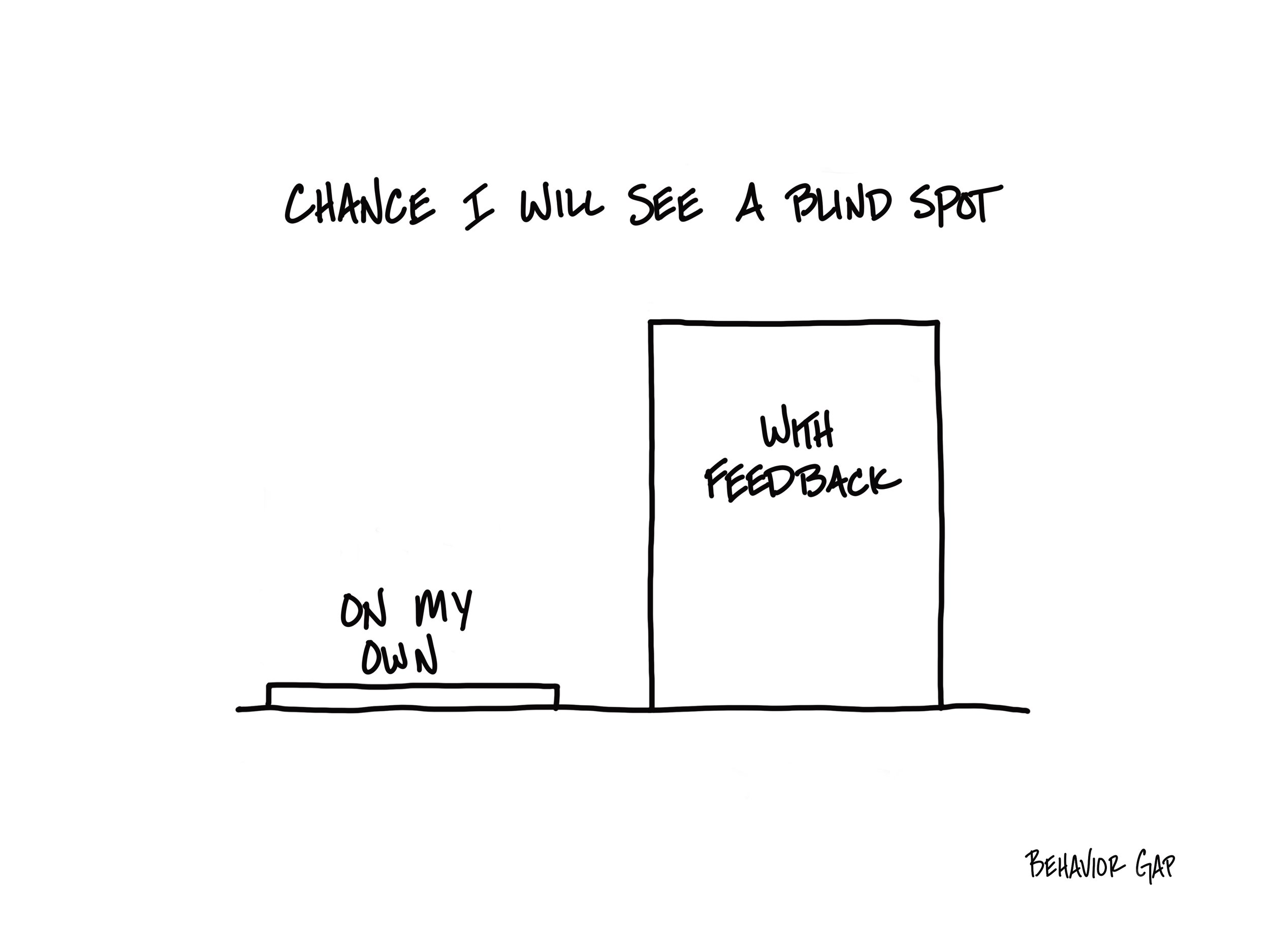

“Information is not knowledge. The only source of knowledge is experience. You need experience to gain wisdom.”

EXPERIENCE AND ACCOUNTABILITY

Our technical expertise and credentials are outliers in this field, but we know that’s not enough.

After we review the data, we apply our analysis to YOUR unique situation, wants, and needs.

Whatever your issue, we have likely seen it before and know appropriate next steps.